The Risks of Simplicity: Understanding Transfer on Death Deeds in New York

For high-net-worth individuals and families in New York, the landscape of real estate succession has shifted over the past year. With the enactment of Real Property Law Section 424 the state introduced an instrument known as the transfer on death deed. This tool has been promoted as a modern, low-cost way to bypass the probate process, but it does not effectively replace a traditional estate plan.

What Is a Transfer on Death Deed?

While the concept appears straightforward, the legal reality is that a transfer on death deed is a specialized tool with narrow applications. For the sophisticated property owner, relying on this instrument without professional guidance can lead to significant financial exposure and unintended distribution consequences.

To understand the problems with transfer on death deeds, one must first understand their mechanics. This deed allows a property owner to name a beneficiary who will automatically inherit the real estate upon the owner’s passing. Unlike a traditional deed, it grants the beneficiary no legal interest while the owner is alive. The owner maintains the absolute right to sell, mortgage, or revoke the deed at any time.

However, the execution requirements are rigorous. The document must be signed by the transferor in the presence of two witnesses and acknowledged by a notary. Most importantly, it must be recorded in the county clerk’s office prior to the owner’s death. Failure to meet these “will-like” formalities renders the deed void, potentially forcing the property back into a lengthy probate proceeding that the owner sought to avoid.

Learn more about how transfer on death deeds work here.

The New York Estate Tax Cliff and Financial Risk

The primary concern regarding a transfer on death deed in New York involves taxation. In 2026, the New York State estate tax exemption will increase to $7,350,000. New York utilizes a “cliff” rule: if an estate exceeds this threshold by more than 5%, the entire exemption is lost. In such cases, the estate is taxed from the first dollar at rates as high as 16%.

Because property passing via this deed is still included in the taxable estate, it can easily push a family over this cliff. Unlike a Revocable Living Trust, which can be structured with credit-shelter provisions to shield assets from this tax trap, a simple deed offers no strategic flexibility. Individuals may find that the “simplicity” of a deed results in a six-figure tax bill that could have been avoided with a more comprehensive plan.

The Incapacity Gap and Asset Protection

Another significant issue is the “incapacity gap.” A transfer on death deed only functions at the moment of death. It provides no authority for a family member or fiduciary to manage, sell, or refinance the property if the owner becomes mentally or physically incapacitated. Without a trust or a robust power of attorney, families may be forced into an expensive and public Article 81 guardianship proceeding.

Furthermore, transfer on death deeds offer no protection against creditors or Medicaid estate recovery. Under New York law, property transferred this way can be “clawed back” for up to 18 months after death to satisfy the decedent’s debts. Because the property remains in the owner’s name during their lifetime, it is also considered a fully available resource for Medicaid eligibility, making transfer on death deeds ineffective for long-term care planning.

Unintended Disinheritance and Marketability Risks

Finally, the statute creates risks regarding the ultimate distribution of assets. If a named beneficiary predeceases the owner, New York’s default rule causes the gift to lapse. This means the property may pass to other surviving beneficiaries rather than to the children of the deceased beneficiary, potentially disinheriting grandchildren. Additionally, the law provides co-tenants with a 180-day right of first refusal, which can complicate or freeze a sale for six months after the owner’s death.

While the transfer on death deed has its place, it is not a substitute for a professionally drafted Will or Trust. To ensure your legacy is protected from tax traps and legal hurdles, it is essential to consult with an experienced estate planning attorney. Bleakley Platt & Schmidt’s Trusts & Estates Practice Group can help navigate potential pitfalls.

Read More

New York’s Challenge to NLRB: A Dual Regulatory Dilemma

Employers in New York State must pay close attention to the unfolding jurisdictional conflict between the state and the federal government over the government administration of labor relations law and employee rights to organize and engage in free speech. A recent legislative maneuver by New York, coupled with a swift response from the National Labor Relations Board (NLRB), has created an uncertain environment for businesses operating within the state. The central issue is the NLRA preemption doctrine, which grants the federal government exclusive authority over most private-sector labor matters for employers engaged in interstate commerce pursuant to NLRB jurisdictional standards.

New York’s Bid for State Jurisdiction

In September 2025, New York Governor Kathy Hochul signed S8034A, an amendment to Section 715 of the New York Labor Law. This “NLRB Trigger Bill” attempts to expand the scope of the New York State Labor Relations Act (NYLRA) to cover private-sector employers and employees who are normally subject to the exclusive jurisdiction of the federal National Labor Relations Act (NLRA). Ironically, NYS merged the State Labor Relations Board (SLRB) into the Public Employment Relations Board (PERB) in July 2010 raising the obvious issue of exactly how the State would be able to handle the additional federal case law with the already congested PERB’s case calendar for both improper practices and representation issues.

The state’s action was a direct response to the federal case backlog stemming from the NLRB’s lack of a three-member quorum since January 2025. While the NLRB’s regional offices continue their day-to-day functions, the lack of a quorum prevents the Board in Washington, D.C. from deciding appeals of both Regional and administrative law judges’ decisions.

The mechanism for this proposed concurrent jurisdictional assertion is highly ambiguous and contingent if not misguided: state intervention would only be triggered if the NLRB does not “successfully” assert jurisdiction, an assertion that the law curiously requires to be pursuant to an order from a federal district court. This requirement ignores the standard administrative processes of the NLRB, which under the NLRA rarely involve federal district court orders other than those for injunctive relief. Nor does it address exactly how PERB can expeditiously handle the proposed federal case backlog.

Review the amendment in its entirety here.

The Federal Counterpunch and Preemption Crisis

The federal government did not let this challenge to its authority stand. Just days after the bill’s signing, news spread that NLRB had filed a federal lawsuit against New York State, seeking a declaratory judgment and an injunction against the amendment. The federal agency asserted that the new State Labor Relations Act provision is fundamentally preempted by the NLRA as confirmed by the U.S. Supreme Court’s 1959 decision in San Diego Building Trades Council v. Garmon.

The core contention is that the NLRA grants the federal Board exclusive authority over most private-sector labor relations engaged in interstate commerce, an authority that remains intact even when the Board lacks a quorum to issue final decisions. Acting General Counsel William B. Cowen stated that the state law “unlawfully usurps” the NLRB’s jurisdiction and creates unwarranted confusion. This news highlights that NLRB’s suit aims to preserve a uniform national labor policy, which the Supreme Court’s Garmon decision has long held bars states from regulating conduct that is even arguably protected or prohibited by the NLRA.

Legal Implications for Employers

For employers engaged in interstate commerce, this inter-governmental conflict presents an immediate and significant escalation in legal complexity and procedural uncertainty.

- Dual Regulatory Threat: Businesses in New York, particularly those facing organizing drives or ULP charges, are now exposed to potential litigation on two fronts: defending the underlying labor charge and simultaneously litigating the federal preemption question over which agency—the NLRB or the state’s PERB—has ultimate authority. This risk of duplicative proceedings and potentially conflicting outcomes drives up legal costs and consumes executive attention.

- Operational Uncertainty: The ambiguity in New York’s “trigger” language regarding when the state’s jurisdiction applies means corporate counsel must now navigate two distinct and potentially contradictory sets of labor relations procedural rules, hindering the ability to establish clear, stable policies.

Until a federal court resolves the preemption challenge, employers must proceed with extreme caution. Businesses with significant operations in New York are encouraged to consult our Labor & Employment Law Practice Group to monitor this litigation closely and maintain strict compliance with established federal labor law, while also preparing for the contingency of state-level agency involvement.

Read More

Navigating the Post-Loper Bright Era: A New Frontier for Employment Litigation Strategy

A recent federal court decision concerning an EEOC right to sue letter has profound implications for corporate decision-makers, signaling a critical shift in how federal employment discrimination statutes are interpreted. The case, Prichard v. Long Island University, represents one of the first judicial applications of the U.S. Supreme Court’s landmark 2024 decision in Loper Bright Enters. v. Raimondo—a ruling that eliminated decades of judicial deference to federal agencies.

The Prichard ruling essentially challenges the Equal Employment Opportunity Commission’s (EEOC) long-standing regulation that allows it to issue an “early” Right-to-Sue (RTS) letter, an outcome that employers must now factor into their litigation strategies.

The Prichard Precedent and the EEOC Early Right-to-Sue Regulation

Title VII of the Civil Rights Act (and by extension, the Americans with Disabilities Act) establishes a mandatory framework for pursuing discrimination claims. Generally, an individual must first file a charge with the EEOC. The statute dictates that the agency issues an EEOC right to sue letter only after either: (1) the EEOC dismisses the charge, or (2) 180 days have passed since the charge was filed, and the EEOC has not filed a lawsuit or entered into a conciliation agreement. This 180-day waiting period is a statutory precondition to filing a federal lawsuit.

However, the EEOC promulgated a regulation (29 C.F.R. § 1601.28(a)(2)) that allows it to issue an early RTS letter upon a charging party’s request if the Commission determines it is probable it won’t complete its administrative processing within the 180-day window. This regulation has historically been a lifeline for plaintiffs seeking to expedite their claims to court, but its validity has been contested, creating a split among federal circuit courts.

In Prichard, a New York federal court was confronted with this precise issue. The plaintiff, Cecilia Prichard, was terminated by Long Island University and filed an ADA charge. At her request, the EEOC issued an early RTS letter just 57 days later. The University moved to dismiss the ensuing lawsuit, arguing the early letter was invalid because the statutory 180-day period had not elapsed.

The Impact of Loper Bright Enters. v. Raimondo

The New York court sided with Long Island University, concluding that the EEOC’s early RTS regulation was incompatible with the clear text of the employment discrimination statute. Crucially, the court explicitly noted that the plaintiff’s reliance on prior cases that upheld the regulation were decided under the now-overruled Chevron deference standard.

The Supreme Court’s decision in Loper Bright vs. Raimondo eliminated this deference, asserting that courts, not administrative agencies, are the ultimate arbiters of statutory meaning. By applying Loper Bright, the Prichard court held that the EEOC had exceeded its statutory authority by issuing the EEOC right to sue letter before the mandatory period expired. This is a seminal moment, representing a direct judicial rejection of an EEOC regulation based on a post-Loper Bright textual analysis of the statute.

Learn more about Loper Bright Enters vs Raimondo’s impact on the Cheveron deference here.

Litigation Strategy Implications for Corporate Employers

For corporate decision makers, the Prichard case opens new strategic avenues regarding employment litigation:

- Controlling the Litigation Timeline: Employers may now be better positioned to challenge an early EEOC right to sue letter, ensuring that the plaintiff is forced to wait the full 180 days before properly filing a lawsuit. This can be a significant tactical advantage, providing the employer with additional time for preparation and potentially extending the plaintiff’s pre-suit timeline.

- Evaluating the Risk of EEOC Investigation: Historically, some employers have welcomed an early RTS letter because it ends the EEOC’s administrative process. A contested charge that remains with the EEOC for the full 180-day period risks a more thorough and potentially burdensome agency investigation, which may involve requests for information (RFIs) that can feel like “free discovery” for the plaintiff.

- Case-by-Case Analysis: The decision to challenge the validity of an early RTS letter is not a one-size-fits-all strategy. In matters where the evidence is overwhelmingly in the employer’s favor or the charge is highly sensitive, fighting the early RTS may be prudent to control timing. However, for charges that are factually complex or involve widespread practices, forcing the charge to remain with the EEOC for a prolonged investigation may carry the greater risk of a negative agency finding or an aggressive RFI that the employer would rather avoid.

The Prichard ruling demonstrates that in the wake of Loper Bright vs. Raimondo, the legal landscape for employment regulation is shifting. Corporate counsel must remain vigilant, as this case may be the first of many to challenge long-standing EEOC regulations that previously enjoyed judicial deference. Employers should work closely with experienced counsel to reassess their litigation strategies in this new era of judicial statutory review. Bleakley Platt & Schmidt’s Labor & Employment Law Practice Group can help clients adjust litigation strategies to account for this important change.

Read MoreAn Overview of NYSDOH’s Revised Certificate of Need Regulations

Effective August 6, 2025, the New York State Department of Health (NYSDOH) adopted revisions to the Certificate of Need (“CON”) regulations for healthcare facility construction under Title 10, Part 710 of the New York State Codes, Rules and Regulations (“NYCRR”). The revisions are aimed at loosening the regulatory requirements governing the establishment and renovation of health care facilities through New York’s certificate-of-need process. The amendments increase the threshold project costs required to trigger each level of regulatory review and approval as follows:

Full Review (proposals that must be recommended by the Public Health and Health Planning Council and approved by the Commissioner of Health):

- General hospitals: proposals with projected costs that exceed $60 million, or 10% of operating costs (with a limit of up to $150 million).

- Other Facilities: proposals with projected costs that exceed over $20 million or 10% of operating costs (up to $30 million).

Administrative Review (proposals that require Commissioner approval only):

- General hospitals: proposals with projected costs between $30 million and $60 million.

- Other Facilities: proposals with projected costs between $8 million and $20 million.

- Projects funded by state grants.

Limited Review (proposals that require limited department review):

- General hospitals: proposals with projected costs of $30 million or less.

- Other Facilities: proposals with projected costs of $8 million or less.

- Mobile van extension clinics.

Notice-Only (proposals that require only written notice to NYSDOH):

- Non-clinical projects over $12 million.

- Facilities that add or renovate exam rooms in existing or adjacent certified space.

- Proposals otherwise eligible for Limited Review and are architecturally self-certified by the applicant, as long as it does not involve a change in the beds or services which would require an update to the applicant’s operating certificate.

Hospitals and other Article 28 facilities should review these new requirements prior to commencing any construction or renovation projects. For more information and regulatory guidance, please contact Robert Braumuller or Zaina S. Khoury at RBraumuller@bpslaw.com or ZKhoury@bpslaw.com.

Read More

Navigating New York State Environmental Regulations: A Strategic Imperative for Corporate Leaders

Corporate decision-makers in New York State face new environmental regulatory challenges. While federal policy has decidedly shifted toward environmental deregulation, New York’s environmental regulators have taken a divergent path, recently enacting some of the nation’s most aggressive regulations. This disparity places corporations in the position of navigating through a legal and operational landscape where federal and state enforcement efforts differ significantly.

The push for federal environmental deregulation, including significant changes to the National Environmental Policy Act (NEPA), has been framed as a way to reduce red tape and streamline operations for various industries. The apparent goal is to lessen the burden of federal oversight and promote economic activity. At the state level, however, New York’s regulators are not bound by federal policy and mandates. The state’s landmark Climate Leadership and Community Protection Act (CLCPA) sets ambitious targets, including an 85% reduction in greenhouse gas emissions from 1990 levels by 2050 and a 100% zero-emission electricity grid by 2040. These goals are at odds with a federal agenda that, in some cases, seeks to promote fossil fuel production.

This regulatory disparity isn’t just a political talking point; it’s a source of tangible business risk. The divide is playing out in courtrooms, with the U.S. Department of Justice challenging New York State environmental regulations like the new climate laws, which seek to hold fossil fuel companies accountable for climate-related damages.

At the same time, environmental organizations are suing New York State for delaying the full implementation of the CLCPA. This legal pressure on the New York State Department of Environmental Conservation (NYSDEC) signals that state-level enforcement is poised to intensify. Companies that hoped to benefit from federal environmental deregulation may find themselves under the intense scrutiny of NYSDEC

Review proposed NYSDEC regulations here.

One of the most significant challenges is the logistical and financial burden of complying with a patchwork of conflicting standards.

Consider the example of a developer planning a large-scale project in New York. Under federal NEPA deregulation, the project might face a streamlined environmental review process. However, to comply with the CLCPA and other rigorous state laws, the company would still need to conduct a comprehensive environmental impact analysis, potentially delaying the project and increasing costs.

The threat is not just current compliance, but also the risk of future re-regulation. Relying on the federal government’s current approach of environmental deregulation is a gamble, as environmental policies are subject to change with each new administration. A corporation that defers investments in new technology or postpones compliance to take advantage of federal rollbacks could face a significant financial and legal aftershock if a new administration re-imposes or strengthens federal regulations.

Given this volatile landscape, it’s critical for corporate leaders to proactively assess their environmental risks and develop a long-term legal strategy that accounts for both short term and long term anticipated federal and state regulations. Staying ahead of the curve means understanding that New York’s commitment to its climate goals is not a passing trend but a legally enforced mandate. This requires a shift from reactive compliance to proactive risk management, ensuring that a company is prepared for a future where stricter environmental standards, not deregulation, are the prevailing norm. Bleakley Platt & Schmidt’s Environmental Law Practice Group is available to help corporations maintain compliance and navigate these evolving regulations.

Read More

A New Era for Municipal Cybersecurity: New York’s Chapter 177 Mandate

New York State has taken a decisive step to strengthen its digital defenses with the enactment of Chapter 177 of the Laws of 2025. This legislation addresses the impact of ransomware attacks that have increasingly targeted local governments. For municipal leaders and IT professionals, this law is a clear signal that cybersecurity is becoming a core responsibility of public service.

New Reporting Rules for Municipalities

Chapter 177 mandates that all New York municipal corporations and public authorities must report cybersecurity incidents and demands for ransom payments to the Division of Homeland Security and Emergency Services (DHSES). The law establishes specific reporting timelines to ensure a swift, coordinated cybersecurity incident response effort.

If a municipality receives a ransom demand, it must provide notice to DHSES within 24 hours, and provide a written explanation detailing why the payment was necessary, the amount, and the method of payment. Municipal requests for technical assistance or advice must be acknowledged by DHSES within 48 hours.

The reports are generally exempt from Freedom of Information requirements to ensure that sensitive incident details remain protected. This is a crucial feature that encourages transparency without compromising security.

A Mandate for Proactive Defense

Beyond the reporting requirements, this new municipal cybersecurity law also mandates cybersecurity training for all municipal and state employees. Local government entities are required to adhere to robust cybersecurity protection and data protection standards. These standards cover essential practices like secure data backup, information system recovery, and vulnerability management. By requiring standardized practices and centralized reporting, New York aims to improve the overall defense of its public infrastructure.

Learn more about municipal cyber-attacks here.

Implications for Private Businesses

While this law directly applies to municipalities, its influence also extends to the private sector, particularly for businesses that contract with or provide services to public entities. Because municipalities are now subject to strict reporting obligations, they will likely demand a higher cybersecurity posture from their vendors and contractors.

Private companies that provide IT services, software, or other critical infrastructure to New York municipalities should be aware that their own cybersecurity practices may come under scrutiny as part of a municipality’s due diligence. This could lead to new contractual clauses and heightened expectations for security standards. The focus on reporting ransom payments may also impact cyber insurance policies, as insurers may begin to require proof of compliance with these new mandates as a condition for coverage or claims processing.

For private businesses, this is an opportunity to get ahead of the curve. Implementing a strong cybersecurity incident response plan, conducting regular employee training, and ensuring compliance with industry best practices are becoming de facto necessities for engaging in public contracts.

Bleakley Platt & Schmidt, LLP has deep experience in information technology & cybersecurity law, helping both public and private sector clients navigate complex legal and regulatory landscapes. We can assist municipalities in understanding and complying with this new law and guide private businesses in preparing for its ripple effects.

Read More

Property Owners and Developers Need to Understand New York’s Revised Wetlands Regulations

The New York State Department of Environmental Conservation (DEC) recently enacted significant changes to its freshwater wetlands regulations. These updates demand immediate attention from owners, developers and site contractors. The changes became effective January 1, 2025.

Prior to these revisions, those seeking to ascertain whether development plans might be impacted by the presence of DEC jurisdictional wetlands could start with existing DEC wetland maps, which provided a degree of predictability for property assessments. The new Article 24 regulations fundamentally alter this approach, shifting to a more granular, parcel-specific review process.

The days of planning based on analysis of the wetland mapper database are over. Every property now requires an individualized jurisdictional determination from DEC, a mandatory initial step in the process that can impact project timelines and associated costs. DEC is required to respond to requests for a jurisdictional determination within 90 days, after which it has limited time to assert jurisdiction, which can result in a waiver of the State’s right to assert jurisdiction at all. Developers now must factor this new procedural hurdle into their project schedules from the outset.

If a letter of positive jurisdiction is issued by DEC, which is now based on an initial desktop-only review by DEC, owners and developers must then schedule an actual wetland delineation site visit with DEC, a next step that creates further delay.

One of the most impactful changes is the expanded reach of the new regulations. DEC estimates that an additional one million acres of freshwater wetlands across the state will now fall under its jurisdiction. This substantial increase includes newly defined “Wetlands of Unusual Importance,” which are now regulated regardless of their size if they meet any of eleven specific criteria. For instance, wetlands in urban areas, those harboring rare plant or animal habitats, or those designated within FEMA floodways, are now subject to state oversight irrespective of their acreage. Learn more about how NYSDEC defines these wetlands here.

Furthermore, the previously established standard 100-foot buffer adjacent to regulated wetlands can now be enlarged. For nutrient-poor wetlands and productive vernal pools, this regulated buffer may be significantly larger, potentially further limiting developable land. Looking ahead to January 1, 2028, the default size threshold for a state-regulated wetland will decrease from 12.4 acres to 7.4 acres, further expanding the scope of new york state regulated freshwater wetlands. This phased implementation underscores the need for continuous vigilance and proactive planning.

These changes present both challenges and opportunities. The immediate implication is an increase in the complexity of environmental due diligence. Longer approval timelines and higher costs for the permitting process and environmental consulting services are now a reality. The new Article 24 also introduces a layer of complexity for municipalities and government agencies striving to ensure compliance with the State Environmental Quality Review Act (SEQRA), which may lead to bottlenecks in local land use approvals. Understanding these moving parts and new implications is paramount for efficient project execution.

The expanded scope of the new wetland regulations means that what was once considered non-jurisdictional land may now be subject to rigorous environmental review and permitting. This necessitates a proactive approach to property assessment and development planning. Engaging an experienced environmental attorney early in the process is no longer just an option; it’s a strategic imperative. We can help you navigate these complexities, from requesting accurate jurisdictional determinations to developing strategies that minimize delays and optimize your project’s financial viability.

Ultimately, these regulatory shifts reshape the calculus for commercial development in New York. Property owners and developers must adapt their strategies to account for increased regulatory scrutiny, extended timelines, and a broadened definition of protected areas. Proactive engagement with legal and environmental experts is the key to successfully safeguarding your commercial interests. Bleakley Platt & Schmidt’s Environmental Law Practice Group can guide you through this evolving regulatory landscape. Contact Jonathan A. Murphy at (914) 287-6165 or jamurphy@bpslaw.com.

Read More

Recent Tariffs Impact Construction Project Costs

Recent changes in trade policy, particularly the imposition of tariffs on construction materials, have introduced significant new challenges for construction firms. As management, you’re likely grappling with the immediate question: how will tariffs affect the costs of construction projects already in progress, especially when it comes to projects with pre-existing, fixed-price contracts? At Bleakley Platt & Schmidt, LLP, we’ve been working closely with our construction clients to address these very concerns, where the central issue is managing price escalation after contracts have been signed.

Many construction firms today find themselves with hundreds of active projects where contracts with owners are already in place. In such situations, the written contract typically governs the relationship. Therefore, a thorough examination of each contract’s specific terms is crucial to determine if there is a contractual basis to seek additional compensation due to tariff-based price increases occurring post-contract execution.

The most direct avenue for relief often lies within a price escalation clause. These clauses are designed to anticipate and address unforeseen material cost increases. Generally, they fall into three common categories:

First, there are “any-increase” escalation clauses. These provisions are the most straightforward, entitling a downstream contractor or supplier to reimbursement for virtually any price increases that occur after the contract’s execution.

Threshold escalation clauses are the second type. These clauses only allow additional compensation if significant price increases occur after signing the contract and exceed a predetermined percentage or dollar amount. This acts as a protective measure against minor fluctuations while still providing recourse for substantial cost jumps.

Finally, delay escalation clauses come into play when project timelines extend beyond expectations. These clauses maintain a fixed price for a limited period but allow for additional compensation to the downstream contractor if the project is delayed beyond a specified number of days or a particular date, thereby accounting for the increased costs incurred during the extended period.

Given the current tariff environment, it is paramount for contractors to diligently review each active contract for the presence of a price escalation clause. Moreover, moving forward, the inclusion of such a clause in any new project contracts should be a high priority for proactive risk management.

Learn more about the role of price escalation clauses in construction contracts here.

What if your existing contracts lack a price escalation clause? While less direct, other contractual provisions might still offer a path to relief from price escalation in construction. Some contracts, for instance, include language that permits extra compensation for changes in law that occur after the parties enter into an agreement. Tariffs, being governmental impositions, could potentially fall under such a provision, depending on the precise wording of your contract.

Another area to explore is whether you can assert force majeure. These clauses typically address delays or non-performance caused by extraordinary events beyond the control of the parties, such as natural disasters, wars, or strikes. The question of whether tariffs qualify as a force majeure event is still evolving in the courts. New York law, notably, tends to interpret force majeure clauses narrowly. This means that performance is generally excused only when the contract specifically lists the event that prevents performance. Therefore, unless your force majeure clause explicitly mentions the imposition of unanticipated tariffs, it might not be deemed a qualifying event. However, a broadly worded force majeure clause, or one with an inclusive “catch-all” provision, could still potentially encompass tariff-related impacts.

Beyond specific contractual language, legal or equitable arguments asserting commercial impracticability, impossibility, or frustration of purpose might offer avenues of relief from tariff-based cost increases. In situations where a contract lacks any cost escalation or force majeure clause, or other provisions addressing unforeseen circumstances, performance might still potentially be excused under the legal doctrine of impossibility.

Ultimately, the most prudent approach for any construction firm is to address material price escalation proactively within the contract itself, rather than relying on potentially uncertain legal and factual arguments after the fact. We at Bleakley Platt & Schmidt, LLP strongly advocate for negotiating appropriate price escalation clauses in all new construction contracts. This foresight can save your firm significant financial strain and legal headaches down the line.

Bleakley Platt & Schmidt, LLP’s Contruction Law Practice Group provides tailored guidance on navigating the impact of tariffs on construction materials and can help fortify your contracts against future price escalation. Strategic planning today can protect your projects and your bottom line tomorrow. Contact Jonathan A. Murphy at (914) 287-6165 or jamurphy@bpslaw.com.

Read More

Proposed 30-Month Medicaid Lookback Period in New York State– What It Could Mean for Community-Based Long-Term Care Recipients

New York State has proposed significant changes to Medicaid that could have major implications for individuals applying to receive home care or assisted living services. Originally expected to be implemented in March 2025, New York’s 30-month Community Medicaid lookback period for non-institutionalized has not yet received final federal approval, but applicants should nevertheless prepare for its potential impact.

Background

Previously, there was no lookback period required for individuals seeking Community Medicaid services. This allowed many seniors and disabled individuals to preserve their assets while receiving the care they need. However, in 2020, the New York State legislature enacted a 30-month lookback period for community long-term coverage in New York for the first time and included a transfer penalty. New York submitted a request to the Centers for Medicare & Medicaid Services (“CMS”) to approve this change in state law. Additionally, implementation was delayed due to prohibitions against new Medicaid restrictions imposed by the federal government during the covid-19 pandemic. Moreover, NY Department of Health officials indicated that they needed more time to implement new procedures and train staff on the new law. It now appears likely that the transfer penalty and thirty-month look-back period may be implemented before the end of 2025. Review the proposal here.

Significance & Consequences

If the proposed 30-month community Medicaid lookback period in New York is enforced, applicants will face various challenges that will require guidance. These challenges may include whether they can shelter excess income through pooled income trusts and how the transfer penalty start date will be calculated. Similar to Medicaid’s nursing home lookback period, it is likely that Community Medicaid applicants would have to provide a comprehensive accounting of all transfers made within the 30-month period immediately preceding their application date in order to determine their eligibility to receive said services. Any uncompensated transfers, such as gifts to family members (other than a spouse), property transfers, or assets placed in trust, could result in a penalty period during which Medicaid coverage for Community Medicaid services would be denied. A New York Medicaid home care lookback period could result in delayed access to critical services such as adult day health care, assisted living programs, certified home health agency services, personal care services, and private duty nursing.

What You Can Do

The implementation of a 30-month lookback period for home care benefits in New York represents a significant shift in Medicaid policy, and individuals planning to apply for Community Medicaid should take proactive steps to protect their financial future.

The Elder Law and Special Needs Practice Group at Bleakley Platt & Schmidt, LLP is dedicated to helping their clients navigate these complex changes in the law and assisting those looking to receive Medicaid Services. Contact Sara L. Keating at (914) 287-6110 or skeating@bpslaw.com.

Read MoreTrump’s Executive Order Seeks to Ban Gender Affirming Care

On January 28, 2025, President Trump signed Executive Order 14187 under the title “Protecting Children From Chemical and Surgical Mutilation.” Under this EO, the federal government “will not fund, sponsor, promote, assist, or support the so-called ‘transition’ of a child from one sex to another, and it will rigorously enforce all laws that prohibit or limit these destructive and life-altering procedures.” If fully implemented, EO 14187 would greatly limit the ability of health care providers to furnish gender affirming care to anyone under the age of 19 years old.

The EO directs the U.S. Attorney General to review federal laws on female genital mutilation to “prioritize enforcement of protections” and “to convene States’ Attorneys General and other law enforcement officers to coordinate the enforcement of laws against female genital mutilation.” This would include bringing federal criminal prosecutions under 18 U.S.C. § 116 against health care providers for prescribing certain hormone and other drug treatments to align their minor patients’ physical characteristics with their perceived sexual identities.

The EO states that the definition of female genital mutilation under Section 116 includes “the use of puberty blockers, including GnRH agonists and other interventions, to delay the onset or progression of normally timed puberty in an individual who does not identify as his or her sex; the use of sex hormones, such as androgen blockers, estrogen, progesterone, or testosterone, to align an individual’s physical appearance with an identity that differs from his or her sex; and surgical procedures that attempt to transform an individual’s physical appearance to align with an identity that differs from his or her sex or that attempt to alter or remove an individual’s sexual organs to minimize or destroy their natural biological functions.”

The EO also directs:

- agencies to rescind or amend policies that rely on guidance from the World Professional Association for Transgender Health (WPATH);

- executive departments and agencies to “immediately take appropriate steps to ensure that institutions receiving Federal research or education grants end the chemical and surgical mutilation of children;”

- the Secretary of HHS to act to “end the chemical and surgical mutilation of children” through regulatory actions by targeting (i) Medicare or Medicaid conditions of participation or conditions for coverage; (ii) clinical-abuse or inappropriate-use assessments relevant to State Medicaid programs” and other actions;

- the Director of the OPM to exclude coverage for pediatric transgender surgeries or hormone treatments by requiring such “provisions in the Federal Employee Health Benefits (FEHB) and Postal Service Health Benefits (PSHB) programs call letter for the 2026 Plan Year”; and

- the Department of Defense to “commence a rulemaking or sub-regulatory action” to restrict access to gender affirming care for children in the TRICARE program.

In addition to potential criminal penalties, the EO further directs the Attorney General “in consultation with the Congress” “to draft, propose, and promote legislation to enact a private right of action for children and the parents” of children who have received gender affirming care “which should include a lengthy statute of limitations.” If such legislation were passed, it is possible that a health care provider who renders gender affirming care to an 18-year-old legal adult who sought out and consented to the care could be sued by the parents. Healthcare providers furnishing gender-affirming care, may thus risk civil lawsuits and criminal prosecution, with limited or no professional liability coverage, because insurers typically exclude coverage for illegal or criminal acts.

Notably, while health care providers who provide gender affirming care to minors may face serious federal liability as result of the implementation of EO 14187, they also may incur liability under New York State laws by refusing to provide such care. New York State Attorney General Letitia James has warned providers who practice in New York that they must continue offering gender affirming care and comply with state discrimination laws. Health care providers who have been providing gender affirming care to minors may face liability for stopping this ongoing care under New York patient abandonment regulations, and for refusing to provide the care in violation of the New York state constitution’s prohibition against discrimination based on sexual identity.

EO 14187 directs all identified agency heads to “submit a single, combined report to the Assistant to the President for Domestic Policy, detailing progress in implementing this order and a timeline for future action” within 60 Days of its issuance. While additional agency guidance has yet to be issued, the EO is currently being challenged in federal court on the grounds that it is openly discriminatory, unlawful, and unconstitutional. On February 13, a federal judge issued a temporary restraining order preventing the federal government from withholding or conditioning funding on the basis of providing this care. We believe that the myriad legal issues raised by the Order will eventually be decided by the U.S. Supreme Court.

Bleakley Platt & Schmidt’s Health Law Practice Group will continue to monitor all legal developments. If you have questions regarding the EO, please contact BPS’s Health Law attorneys, Robert Braumuller (914-287-6185 or rbraumuller@bpslaw.com) and Zaina Khoury (914-287-6187 or zkhoury@bpslaw.com).

Read More

Neville et al. v. Snap, Inc.: A Potential Game-Changer for the Social Media Free Speech Debate

The digital realm is constantly evolving, and with it, the legal framework that governs online interactions. Now a California lawsuit, Neville et al. v. Snap, Inc., is challenging the long-held understanding of the protections provided to owners of social media platforms by Section 230 of the Communications Decency Act of 1996. Beyond fueling debates surrounding social media and free speech, a final result in favor of the plaintiffs in that action could potentially reshape the liability landscape for social media companies and the broader tech industry.

Understanding Section 230

Section 230 (47 U.S.C. § 230) is a cornerstone of internet law. It generally protects “providers of an interactive computer service” from being treated as the “publisher or speaker” of information shared by third parties on their platforms. This protection has historically served as a broad shield for tech companies against lawsuits based on user-generated content. The intent behind Section 230 was to foster innovation and free speech online, preventing platforms from over-censoring content for fear of liability. It’s important to note Section 230 does not protect conduct that violates any federal criminal statute, electronic communications privacy law, or intellectual property rights.

The Neville et al. v. Snap, Inc. Challenge: Beyond Content Moderation.

Neville et al. v. Snap, Inc. involves claims brought by parents whose children allegedly purchased fentanyl-laced drugs through connections made with sellers using the social media app Snapchat, leading to serious injuries and deaths. The plaintiffs argue that Snapchat’s features and design facilitated these illegal transactions, creating an “open-air drug market” within the app.

Unlike previous lawsuits that have focused on content moderation, the Neville case centers on the platform’s features and design as factors causally related to the injuries alleged. The plaintiffs argue that Snapchat’s features, such as automatic message deletion, location mapping, and “quick-add,” create an environment conducive to illegal drug sales. They also contend that Snap was aware of the use of its app to facilitate illicit drug transactions, but failed to implement adequate safeguards. Moving to dismiss the plaintiff’s complaint, Snap invoked Section 230 immunity, arguing that the alleged harm stemmed from third-party content and therefore fell under the broad protections of Section 230.

The Court’s Decision: A Shift in Perspective?

In a 34-page opinion sustaining the legal sufficiency of several of the plaintiffs’ claims as pleaded, including those alleging negligence, fraud, and misrepresentation, the California Superior Court for the County of Los Angeles disagreed with Snap’s interpretation. While acknowledging Snapchat as an “interactive computer service” and recognizing that Section 230 protects social media companies against liability as a “publisher or speaker,” the court determined that the plaintiffs’ claims were not based on Snap simply acting as a “publisher or speaker.” Rather, the court accepted the plaintiffs’ argument that their claims focus on the alleged dangers of Snap’s product design and business decisions, independent of the content posted by sellers of illicit drugs. The court emphasized that these claims were beyond Snap’s “incidental editorial functions,” which are typically protected by Section 230.

Read the court’s opinion in full here.

One to Watch

If the Neville plaintiffs ultimately prevail on their claims – a result that will depend on numerous legal and evidentiary issues yet to be addressed – such an outcome could have significant implications for the tech industry in general and social media platforms in particular. But while the final outcome of the Neville case remains a distant unknown at this time, even at this early stage of the litigation it represents a notable moment in the ongoing debate about social media free speech, the protections of Section 230, and the responsibilities of social media companies, highlighting the complex intersection of technology, law, and public safety. Bleakley Platt & Schmidt’s Litigation Practice Group will continue to closely monitor this case as it proceeds.

Prenatal Leave in NYS According to Labor and Employment Law Attorneys

New York employers, take note. A significant change is coming in 2025 regarding employee leave. New York is the first state in the nation to require employers to provide paid prenatal leave for pregnant workers. While the major points of this legislation are straightforward, the State’s lack of guidance on finer points, like recordkeeping, has the potential to create pitfalls for employers. Because the law becomes affective January 1, 2025, managers should consult a labor and employment law attorney for compliance strategies in the absence of such guidance.

Background: NYS Paid Prenatal Leave

Governor Kathy Hochul signed legislation in April 2024 expanding the New York Paid Family Leave Law (NY PFL) to include 20 hours of paid leave for prenatal doctor appointments within a 52-week calendar period.

The new law is separate from existing sick leave and safe leave provisions. Employees can use this new benefit for a variety of pregnancy-related healthcare services, including:

- Physical examinations

- Medical procedures

- Monitoring and testing

- Discussions with healthcare providers

Key Considerations for Employers

- Eligibility: All pregnant employees, regardless of length of service, are entitled to NYS’ paid prenatal leave benefit.

- Leave Usage: The 20 hours can be used in hourly increments and is paid out in the same manner.

- Employee Rights: Employers cannot retaliate against employees for using prenatal leave. Upon return, they must be restored to their previous position with the same terms and conditions of employment. Unused leave does not need to be paid out at the end of employment.

Current Unknowns and Recommendations

NYS’ paid prenatal law remains silent on some crucial details for employers. Proactive managers will do well to consult with legal counsel and strategize on compliance in the absence of clarification regarding:

- Recordkeeping Requirements: There are currently no regulations on how employers must track this leave.

- Notice Requirements: It’s unclear if employers need to provide specific notification regarding this benefit.

- Poster Requirements: As of this time, no official posters have mandated.

- Timing of Guidance: Although the State has promised to provide guidance on the above points prior to the law’s affective date, no specifics have been given as to when this additional detail can be expected.

Staying Compliant: Consult a Labor and Employment Law Attorney

While the new law offers significant benefits for pregnant employees, employers must adequately prepare for its implementation. Bleakley Platt & Schmidt’s Labor & Employment Law Practice Group can assist you in revising your paid leave policies, ensuring compliance with the upcoming changes and addressing any specific concerns you may have. We anticipate eventual guidance from the State regarding recordkeeping, notice, and potential carryover provisions before the law takes effect.

Read More

How Litigation Lawyers Protect Your Organization

In the dynamic and competitive business landscape, disputes are an unfortunate reality. Whether it’s a contract breach, a shareholder disagreement, or an environmental concern, litigation can disrupt operations, damage your reputation, and erode your bottom line. At Bleakley Platt & Schmidt, LLP, our experienced litigation lawyers understand the unique challenges faced by corporations and are dedicated to providing comprehensive solutions.

What is Litigation?

Litigation is the legal process of resolving disputes through the court system. It involves various stages, including filing lawsuits, a discovery phase for exchanging information, presentation of arguments, trial, and appeal. While most cases ultimately settle through alternative means like negotiation, mediation, or arbitration, understanding the litigation process is crucial for effective dispute resolution.

Dive deeper into the field of litigation here.

Bleakley By Your Side

BPS’s business litigation attorneys have a proven track record of success in complex matters. Our team represents businesses of all sizes, from Fortune 500 companies to local startups. We offer a comprehensive approach, including:

- Litigation Avoidance: We believe the best defense is a good offense. Our attorneys advise on contract formation, risk management, and negotiation strategies to minimize the chance of litigation.

- Pre-Litigation Strategy: When a dispute arises, our litigation lawyers can assess the situation, develop a winning strategy, and guide you through every step of the process.

- Cost-Effective Solutions: We understand litigation can be expensive, and work to achieve your goals while keeping costs in check.

- Extensive Experience: Our attorneys have deep expertise in various areas of business law, including contract disputes, shareholder and partnership disputes, mergers & acquisitions, intellectual property, and class actions.

Our litigation services, span more than a dozen practice areas. Here is a look at how BPS litigators apply their expertise to some of our largest practices:

Health Care Litigation: Navigating Complex Regulatory Waters

The healthcare industry is subject to a complex and ever-changing regulatory environment. Disputes involving hospitals, nursing homes, healthcare providers, and other healthcare entities require specialized knowledge and experience. BPS’s Health Care Litigation Practice Group provides comprehensive legal counsel to protect your interests.

Our attorneys represent clients in a wide range of matters, including:

- Compliance and Regulatory Investigations: We help healthcare providers navigate complex regulatory compliance issues and conduct internal investigations related to Medicare, Medicaid, fraud/abuse allegations, and false claims.

- False Claims Act: We have a strong track record of defending healthcare providers against allegations of fraud and abuse.

- Medicare and Medicaid Reimbursement: We assist clients in maximizing reimbursement and resolving disputes with government payers.

- Licensing and Certification Issues: We help healthcare providers obtain and maintain necessary licenses and certifications.

Corporate Litigation: Protecting Your Business Interests

Corporate litigation encompasses a broad range of disputes involving companies, shareholders, directors, and officers. Our Corporate Law Practice Group has extensive experience handling complex business disputes, including:

- Merger and Acquisition Litigation: We assist clients in resolving disputes related to mergers, acquisitions, and corporate control.

- Contract Disputes: We help businesses enforce their rights and protect their interests in contract disputes.

- Complex Commercial Litigation: We handle complex litigation matters involving multiple parties and high stakes.

Environmental Litigation: Mitigating Risks

Environmental compliance and litigation are critical concerns for businesses operating in today’s regulatory landscape. BPS’s Environmental Law Practice Group provides comprehensive legal counsel to help you manage environmental risks and protect your company’s reputation.

Our attorneys have extensive experience in:

- Superfund Litigation: We represent clients in complex Superfund matters, including site assessments, remediation, and cost recovery.

- Environmental Compliance: We assist clients in developing and implementing compliance programs to avoid costly litigation.

- Permitting and Regulatory Compliance: We help clients obtain necessary permits and comply with environmental regulations.

- Environmental Cleanup and Remediation: We provide strategic guidance on environmental cleanup and remediation projects.

- Natural Resource Damages: We defend clients against claims for natural resource damages.

Bleakley Platt & Schmidt: Your Trusted Litigators

At BPS, we are committed to providing exceptional legal representation and strategic guidance to our clients. Our litigation lawyers have the knowledge, experience, and resources to help you navigate complex legal challenges and achieve your business objectives. Contact our Litigation Practice Group today.

Read More

F Reorganizations Can Benefit Buyers and Sellers in Business Acquisitions

Certain corporate characteristics of a target company may be undesirable to potential buyers preventing them from acquiring the company. For example, the target company may be an S corporation, and the potential buyer would not qualify to be a shareholder of an S corporation under Internal Revenue Service (IRS) rules. Alternatively, the buyer may want the target company to be incorporated in a different state, such as Delaware, due to that state’s well-developed corporate law and chancery court system. In such situations and others, the seller can remove these obstacles prior to a sale by performing an “F reorganization,” a tax-free corporate reorganization under Internal Revenue Code (IRC) § 368(a)(1)(F). The IRC defines an F reorganization as a mere change of identity, form or place of organization of a corporation.1

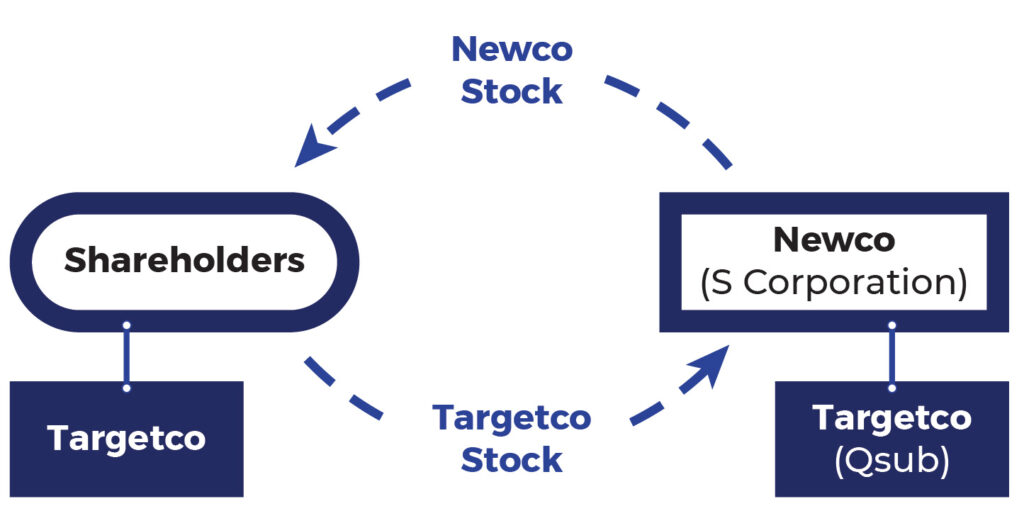

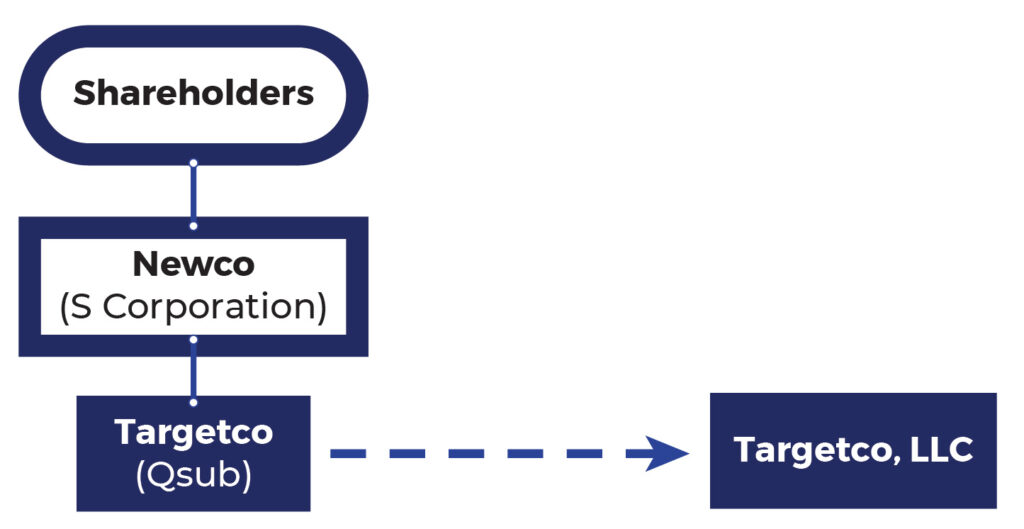

After undergoing an F reorganization, the target company may become a different type of entity, such as a limited liability company, and may be incorporated in another state. It will become a wholly owned subsidiary of a newly formed corporation (“Newco”). The steps to reach this result are as follows. First, the seller forms Newco as an S corporation. Second, the shareholders of the target company contribute all their shares to Newco in exchange for the stock of Newco. Newco elects to treat the target company, the shares of which it now owns, as a qualified subchapter S subsidiary (“Qsub”) so that it becomes a disregarded entity for federal income tax purposes. Third, the target company converts into a limited liability company under state law or merges into another subsidiary LLC formed in Delaware and remains a disregarded entity for federal income tax purposes.

The following diagrams illustrate steps 2 and 3:

Step Two

Step Three

As a result of the reorganization, the individual shareholders own all the equity of Newco in the same proportions that they owned the target company. Newco is the single member of the target company and now is the seller in the proposed business sale transaction. After the reorganization, the target company is now an LLC and becomes attractive to a wider array of buyers because the restrictions under Subchapter S of the IRC2 on who may own shares of the company no longer apply. Additionally, the target company is now a Delaware company.

Sometimes, the parties may want their transaction to include only some of the selling company’s assets. An F reorganization permits them to structure the transaction to sell less than all assets of the target business. To accomplish this, after the F reorganization is completed, the seller causes the target company to distribute up to Newco the assets that it wishes to retain. Then, only the assets that the buyer wishes to acquire will remain in the target company before the buyer purchases it. The F reorganization benefits both parties in this situation by enabling them to accommodate their business goals of transferring only some of the target company’s assets.

An F reorganization offers other benefits as well. After an F reorganization, the seller can treat the business transaction as a sale of equity interests, while the Buyer can treat it for tax purposes as an asset purchase transaction. For the seller, at least part of the sale proceeds may be subject to long term capital gains rates, which are lower than ordinary income tax rates. The buyer benefits from a step-up in the basis of the target’s assets equal to the purchase price. In addition, the buyer does not need to obtain third party consents associated with transferring assets (rather than equity interests). This can be valuable to the buyer of a health care provider, such as a clinical laboratory, by enabling the target company being acquired to retain any valuable health insurance and other third party payor contracts that it has in place.

A well-conceived F reorganization can offer buyers and sellers a valuable means to restructure target companies or buyer entities prior to business acquisitions to achieve various corporate and tax goals. The terms of such a restructuring can be specified in the parties’ purchase agreement and their implementation can be stated as a closing condition. Members of our firm’s corporate practice can help buyers or sellers of businesses use this corporate restructuring technique to reach agreement, maximize tax efficiencies and achieve other corporate goals in contemplated business acquisitions.

Read More

New York Breastfeeding Law: Paid Lactation Breaks Explained for Employers

New York State has amended its labor law to accommodate breastfeeding mothers in the workplace. As of last month, employers are required to provide paid breastfeeding breaks. This update to Section 206-c of the New York Labor Law creates significant changes to workplace breastfeeding policies and numerous considerations for compliance.

Changes to New York Breastfeeding Law for the Workplace

Previously, New York mandated that employers provide one unpaid break every three hours for nursing mothers to express breast milk. However, the recent amendment changes the equation:

- Paid Breaks: Employers must now provide up to 30 minutes of paid breastfeeding break time each time an employee needs to express breast milk. This applies for up to three years following childbirth.

- Flexibility: Employees can combine existing paid breaks or mealtimes with the allotted 30 minutes if their pumping needs exceed that timeframe.

- Discrimination Protection: The law explicitly prohibits employers from discriminating against employees for expressing breast milk in the workplace.

Resources and Compliance

The New York State Department of Labor (NYSDOL) has taken steps to ensure employers are aware of these changes:

- Updated FAQs: The NYSDOL FAQs address paid lactation breaks and clarify employers’ obligations.

- Revised Policy: The NYSDOL Policy on the Rights of Employees to Express Breast Milk in the Workplace has been updated and needs to be distributed to employees upon hire, annually, and upon returning from childbirth leave.

- Fact Sheets: Separate fact sheets on the amendment, one for employers and another for employees, are available on the NYSDOL website.

The NYSDOL emphasizes that employers must accommodate employees’ reasonable requests for breaks and acknowledges that the number of breaks needed can vary depending on the individual.

What New York Employers Should Do Now

Because of these changes, New York employers should consider the following:

- Review and Update Policies: Work with legal counsel to review and update existing lactation accommodation and leave policies to reflect the new paid breastfeeding break requirement.

- Employee Communication: Disseminate clear and accurate information to employees regarding the amended law. Consider providing training for managers and supervisors on handling employee requests for lactation breaks.

- Accommodation Strategies: Develop a plan for providing a clean and private space for expressing breast milk in the workplace. This could be a dedicated lactation room or a designated, private area.

Staying Compliant

By understanding these changes and taking proactive steps, New York employers can ensure compliance with the new breastfeeding amendment to the Labor Law. Bleakley Platt & Schmidt, LLP’s Labor & Employment Practice Group is experienced in navigating workplace regulations and can assist your company in developing compliant lactation break policies and practices.

Municipalities Must Re-Think Traditional Exclusionary Zoning to Allow Greater Flexibility for Mixed Use/Residential Development

Given the post-pandemic adjustments to our daily work and life patterns, high interest rates and decreased demand for office and retail space in Westchester County and throughout the Hudson Valley, the time is now for municipalities to embrace forward-thinking changes to outdated, onerous and restrictive zoning codes. Rather than put every zoning use in its own separate, exclusionary rigid box of residential, commercial or office, municipalities should allow for more flexible zones with a combination of such uses based on the needs of the community.

The time for municipalities to embrace mixed-use zoning is now. Downstream consequences of the Fed’s tightening program are surfacing and signaling slower growth ahead. This is particularly true for office and retail properties. Office-using employment lagged the Hudson Valley’s overall growth rate, increasing just 0.1% year-over-year. See CBRE Figures – Westchester County – Q1 2023. The Wall Street Journal reports that lending for offices has plummeted to 35 percent of 2019 figures with retail not far behind. The consequences of this are that municipalities are potentially left with vacant and underperforming buildings which lead to other negative impacts in the community, loss of ratables, blight etc. Conversely, the demand for residential, multi-family development is booming and there is simply not enough of it.

The COVID-19 pandemic did not cause this trend. The pandemic accelerated trends that have been going on for years, namely the densification of assets through the redevelopment of properties, which are often retail centers or low-rise office sites. See Multi-Housing News 9-14-20. Based on this market reality, the retail and office landscape has changed, causing developers to reimagine their existing offices and shopping centers by adding residential developments to those properties. This pattern is the next logical step, as it adds market rate units to cater to the growing young millennial and empty-nester population, while at the same time bringing new life to underutilized commercial buildings and needed tax ratables to municipalities. In the area of retail centers, adding residential development to those properties provides those retail developers with an instant customer base, namely, residents seeking the live-work-play model of providing retail, dining, and entertainment all under one roof – all within walking distance.

Local municipal officials should seize this golden opportunity to reinvigorate their zoning codes to allow residential development in commercial/retail zone districts. Shifting consumer trends have led to vacancies in many commercial areas. To keep these areas viable and satisfy the need for housing options, municipalities should explore zone changes that would permit residential uses in pre-existing commercial zones. While municipalities may be hesitant to engage in this exercise due to factors stemming from lack of political will, fears of changing the character of the local neighborhoods and public opposition, such factors can be overcome with the right mix of expert input from professionals, open dialogue with stakeholders, community members and municipal officials, and a needs-based assessment of the type of mixed-used development appropriate for a particular site. By the same token, this exercise to provide more flexible zoning should not be an onerous task marred by massive, costly and at times, lengthy timeframes, and logistical problems.

Adding residential use to commercial zones is an opportunity to transform local municipalities for the better. Municipalities should not fear such conversions, but rather embrace it and remove draconian zoning laws that no longer comport with modern world realities. The days of traditional exclusionary zoning, and strict separation of uses are outdated and stifle the ability of municipalities to evolve. Bleakley Platt & Schmidt’s Land Use & Zoning Law Practice Group can help develop strategies for overdue zoning law updates. Contact Lino Sciarretta at (914) 287-6177 or lsciarretta@bpslaw.com. To learn more about our Land Use & Zoning Law Practice Group, click here.

Read More

First Deadline of NYC’s Local Law 154 of 2021 Looms

With the passage of Local Law 154 of 2021 (the “All-Electric New Buildings Law”), New York City became the largest city in the world to require that newly constructed buildings operate solely on electricity. This law means new buildings, with few exceptions, will be all-electric and emit less carbon, with the goal of improving local air quality. The law is a significant milestone in the city’s push to decrease greenhouse gas emissions and sets ambitious targets for reducing the city’s carbon footprint. It is important for all developers, owners, and builders to be aware of the law’s regulations to ensure compliance and plan for similar transitions as this trend continues.

Local Law 154 is inaccurately referred to as an “NYC fossil fuel ban.” In actuality, the law imposes strict carbon dioxide limits on newly constructed buildings by prohibiting the use of any substance that emits over 25 kg of CO2 per million BTUs. This effectively bans the use of:

- propane

- diesel

- home heating fuel

- kerosene

- natural gas

- gasoline

- residual heating fuel in new buildings

The target of Local Law 154 is new construction. New buildings under seven stories must be fully electric by January 2024. Buildings over seven stories must comply by July 2027.

Major renovations that increase a building’s floor surface area by more than 110% are also subject to the law’s provisions. The Department of Buildings will enforce Local Law 154 through its existing construction document review process. Click here to read the law in its entirety.

However, the law also includes exemptions for certain types of buildings. These include:

- facilities requiring fossil fuel combustion for manufacturing

- laboratories

- commercial kitchens

- hospitals

- crematoriums

- buildings used by utilities to generate electricity or steam

- buildings used to treat sewage or food waste

While Local Law 154 does not address retrofitting current buildings, Local Law 97 is forthcoming. Both laws aim to reduce building emissions by 40% by 2030 and 80% by 2050. Local Law 97 requires buildings over 25,000 square feet to meet lower emissions limits over the next decade.

The new emission thresholds starting in 2024 will affect only the top 20% of emitters. By 2030 the law will impact 75% of New York City’s buildings.

Local Law 154 represents a bold initiative in New York City’s efforts to reduce greenhouse gas emissions. Commercial real estate developers, building owners, and construction companies must become familiar with these new regulations to ensure compliance.

For counsel on this historic law and the larger trend it represents, contact Jonathan A. Murphy of Bleakley Platt & Schmidt’s Construction Law Practice Group at (914) 287-6165 or jamurphy@bpslaw.com.

To consult the Real Estate Practice Group on this matter, contact Peter N. Bassano at (914) 287-6102 or pbassano@bpslaw.com.

Read More

SCOTUS Ruling Clarifies Overtime for Daily-Rate Employees Under FLSA

On February 22, 2023, in Helix Energy Solutions Group, Inc. v. Hewitt, No. 21-984, the U.S. Supreme Court in a 6-3 decision held that a “highly compensated executive employee” who was paid at a daily rate and not paid on a “salary basis” at the then-required $455 weekly salary was not exempt from the overtime provisions of the Fair Labor Standards Act (FLSA).

The employer, an offshore oil and gas company based in Houston, claimed that its former employee, a highly paid executive, earning more than $200,000 per year at a daily pay rate, was exempt from overtime pay because he received at least $455 each week, meeting the minimum standard for salaried workers at the time. The former employee claimed that he was entitled to overtime payments as he was not paid at FLSA’s then-required $455 weekly salary. According to the Curt’s record, the former employee from 2015 to 2017 lived on an offshore oil rig for 28 days at a time while being on-duty for 12 hours each day. He was paid during this period from $963 to $1,341 per day, and earned $248,053 in 2015 and $218,863 in 2016.

In analyzing the FLSA regulations governing what constitutes being paid on “salary basis” and the “highly compensated employee” exemption, the Supreme Court, in an opinion authored by Justice Kagan, found that a daily rate, even one that exceeded the weekly salary minimum, did not satisfy the “salary basis” test required by the regulation because it constituted a guaranteed payment per day, not per week. According to Justice Kagan, however, employers can satisfy the “salary basis” test for “highly compensated” employees paid at a daily rate paying the employee a defined weekly amount, along with a day rate for extra days, so long as there is a “reasonable relationship” between the weekly guarantee and the total amount actually paid.

Unfortunately for employers, the issue of what constitutes a “reasonable relationship” is not defined by FLSA regulation, other than the U.S. Department of Labor’s guidance in FLSA opinion letter 2018-15 on this issue. While this FLSA opinion letter acknowledges that the 1.5-to-1 ratio of guaranteed weekly salary to actual earnings may signify the existence of a reasonable relationship, the Department further stated in this letter that where actual or usual earnings are approximately 1.8 times the guaranteed weekly salary—or nearly double—the guaranteed weekly salary “materially exceed[s]” the permissible ratio of the regulation. Accordingly, employers should therefore seek the advice of counsel in classifying “highly compensated” employees as exempt even when they are paid at the current guaranteed FLSA salary of $684 per week to determine if a “reasonable relationship” exists between the employee’s actual and guaranteed weekly earnings within the meaning of the Department’s FLSA guidance.

Read More

National Labor Relations Board Decision Places Limits on Severance Agreements

On February 21, 2023, in McLaren Macomb, 372 NLRB No. 58, the National Labor Relations Board held that employers may not offer severance agreements to employees which require these employees “to broadly waive their rights under the National Labor Relations Act [Act].” The McLaren decision involved severance agreements offered to furloughed employees which prohibited them from making any disparaging statements against the employer and from disclosing the terms of the agreement itself. McLaren now places limits on the use of confidentiality, non-disclosure, and non-disparagement clauses that employers may include in severance agreements. The decision reverses prior NLRB precedent in 2020 which found that similar severance agreements were not unlawful by themselves.

While the Act applies to most private sector employers and the U.S. Postal Services, including those with a non-union workforce, the McLaren decision does not apply to employees who are excluded from the act’s coverage, such as managers and supervisors. Moreover, the decision makes clear that the “free speech” of employees under Section 7 of the Act requires that “employee critique of employer policy pursuant to the clear right under the act to publicize labor disputes is subject only to the requirement that employees’ communications not be so disloyal, reckless or maliciously untrue to lose the act’s protection.”

Based on the broad language of the McLaren decision, employers should review the language they use in severance and separation agreements and discuss with legal counsel whether that language should be modified, including those non-disparagement and confidentiality clauses found in pre-existing agreements.

Read More

Labor and Employment Law: Updates to New York State Leave Protections

The New York Labor Law has been amended to provide protection for certain employee absences. The new law takes effect on February 20, 2023. The law aims to prohibit employers from penalizing employees who take legally-protected absences, including those defined by federal, local, or state employment law, and forbids “no-fault” attendance policies. The stated purpose of the amendment to Section 215.1(a) of the Labor Law is “[t]o ensure that it shall be retaliation for an employer to discipline workers by assessing points or deductions from a timebank when an employee has used any legally protected absence.”

Protected absences now include days off taken in accordance with federal and New York State leave laws. Employers may not discharge, threaten, penalize, or retaliate against employees for taking protected absences.

“No-fault,” points-based attendance policies that punish employees and impose consequences on employees for taking protected absences are restricted under this law. This includes disciplinary actions that may be taken once an employee reaches a certain number of absences. Employers cannot now deduct points or take away pay or promotions from employees for taking a protected leave.

This amendment to the NY Labor Law also provides a legal avenue for claims against employers who retaliate against employees for taking protected leave. There may be a private cause of action that allows employees to seek back pay, front pay, reinstatement, and/or liquidated damages when experiencing retaliation related to protected leaves.

Companies should review their policies to ensure compliance with the amended law. Practices that penalize protected absences should be identified and revised. Organizations that formerly used no-fault attendance policies will need to train managers and HR personnel on updated procedures.

The new law covers many types of legally protected absences, including, inter alia, leave under the Family and Medical Leave Act, which provides certain eligible employees with up to 12 weeks of unpaid leave per year for specific family and medical reasons; the New York State Paid Family Leave Law, which provides certain eligible employees with up to 12 weeks of job-protected paid time off to bond with a new child, care for a family member with a serious health condition, or help relieve family pressures when someone is called to active military service; the New York State and City Paid Sick Leave Law, which provides eligible employees with paid sick leave for personal and family health needs; as well as other legally-protected absences such as time off for military service, jury duty, and voting.